vermont state tax form

Application for Business Tax Account Form BR-400 Whether starting a new business in Vermont or seeking to register a foreign non-Vermont entity to do business in the state of Vermont the. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Tax Vermont Exempt Fill Out Sign Online Dochub

Vermont Form IN-111 2018.

. IN-111 Vermont Income Tax Return. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

Instructions for Form 1040 Form W-9. Vermont Individual Income Tax Return. Form IN-114 - Estimated Income Tax.

PA-1 Special Power of Attorney. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Vermont Form IN-111 2018.

W-4VT Employees Withholding Allowance Certificate. Nonresident alien who becomes a resident alien. The state income tax table can be found inside the Vermont Form IN-111.

PUBLIC INFORMATION REQUESTS TO. IN-111 Vermont Income Tax Return. Taxpayers in Vermont file Form IN-111 the long version of the Vermont Individual Income Tax Return for their income.

Please include your full name company name if. Vermont Individual Income Tax Return. B-2 Notice of Change.

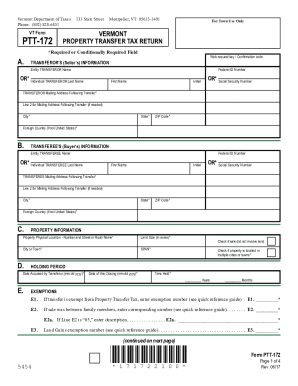

Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a single service. Learn about the regulations for paying taxes and titling motor vehicles.

If claimants believe their 1099-G to be incorrect. Vermont Department of Taxes. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

Vermont State Income Tax Forms for Tax Year 2021 Jan. Information provided on 1099-G forms is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes.

Estimated tax payments must be sent to the. Taxpayers in Vermont file Form IN-111 the long version of the Vermont Individual Income Tax Return for their income. The appropriate Form W-8 or Form 8233 see Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

Details on how to only prepare and. The Vermont income tax rate for tax year 2021 is progressive from a low of 335 to a high of 875. Please mail your written request to.

The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more. TaxFormFinder provides printable PDF copies of 52 current. W-4VT Employees Withholding Allowance Certificate.

802 828-2301 Toll Free. If you file a. PA-1 Special Power of Attorney.

Vermont School District Codes. Individual Tax Return Form 1040 Instructions.

Vermont Form 2290 E File Highway Vehicle Use Tax Return

State Corporate Income Tax Rates And Brackets Tax Foundation

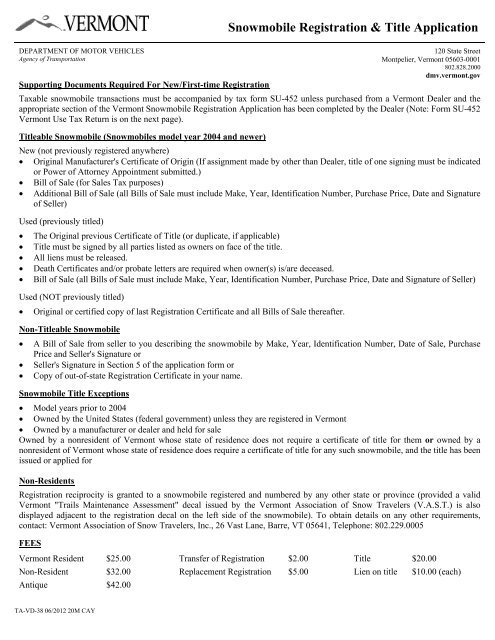

Snowmobile Registration Amp Title Application Vermont Department

Form In 111 Vermont Income Tax Return

The Complete J1 Student Guide To Tax In The Us

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

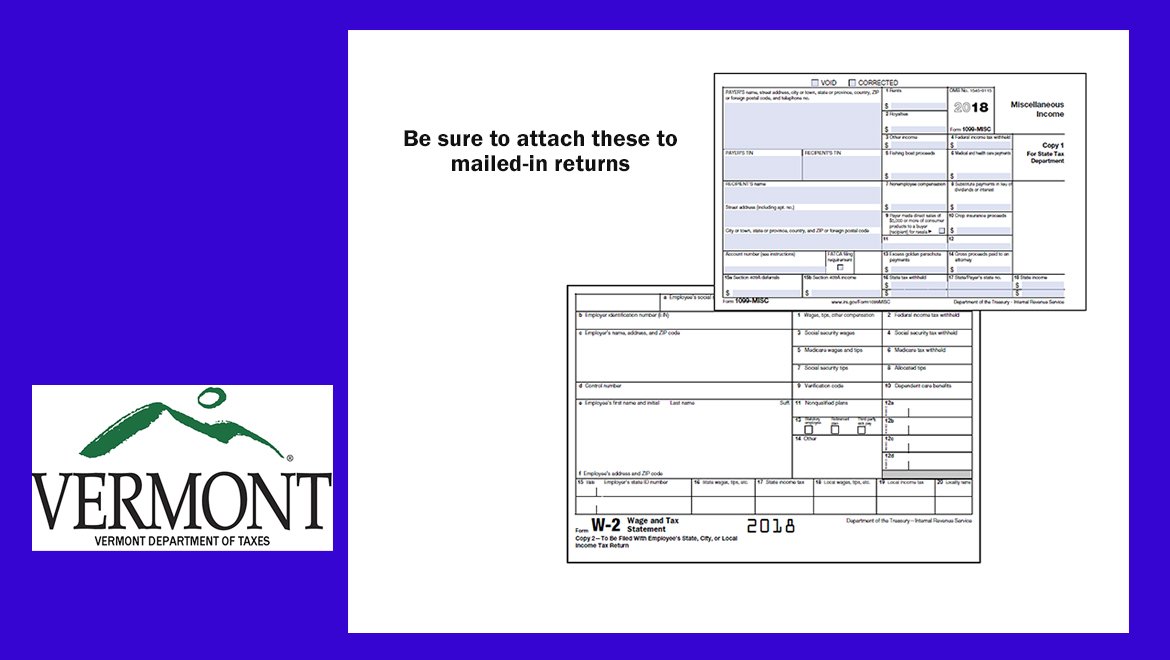

Vt Dept Of Taxes On Twitter The Vermont Department Of Taxes Is No Longer Participating In The Combined Federal State Program For Submitting W 2 And 1099 Forms With The Irs You Must Now

Form In 111 Fillable Vermont Income Tax Return

2020 2022 Vt Dot Ptt 172 Formerly Pt 172 Fill Online Printable Fillable Blank Pdffiller

Vermont Tax Commissioner Reminds Vermonters To Pay Use Tax Vermont Business Magazine

Filing A Vermont Income Tax Return Things To Know Credit Karma

How To File And Pay Sales Tax In Vermont Taxvalet

State W 4 Form Detailed Withholding Forms By State Chart

State Withholding Form H R Block

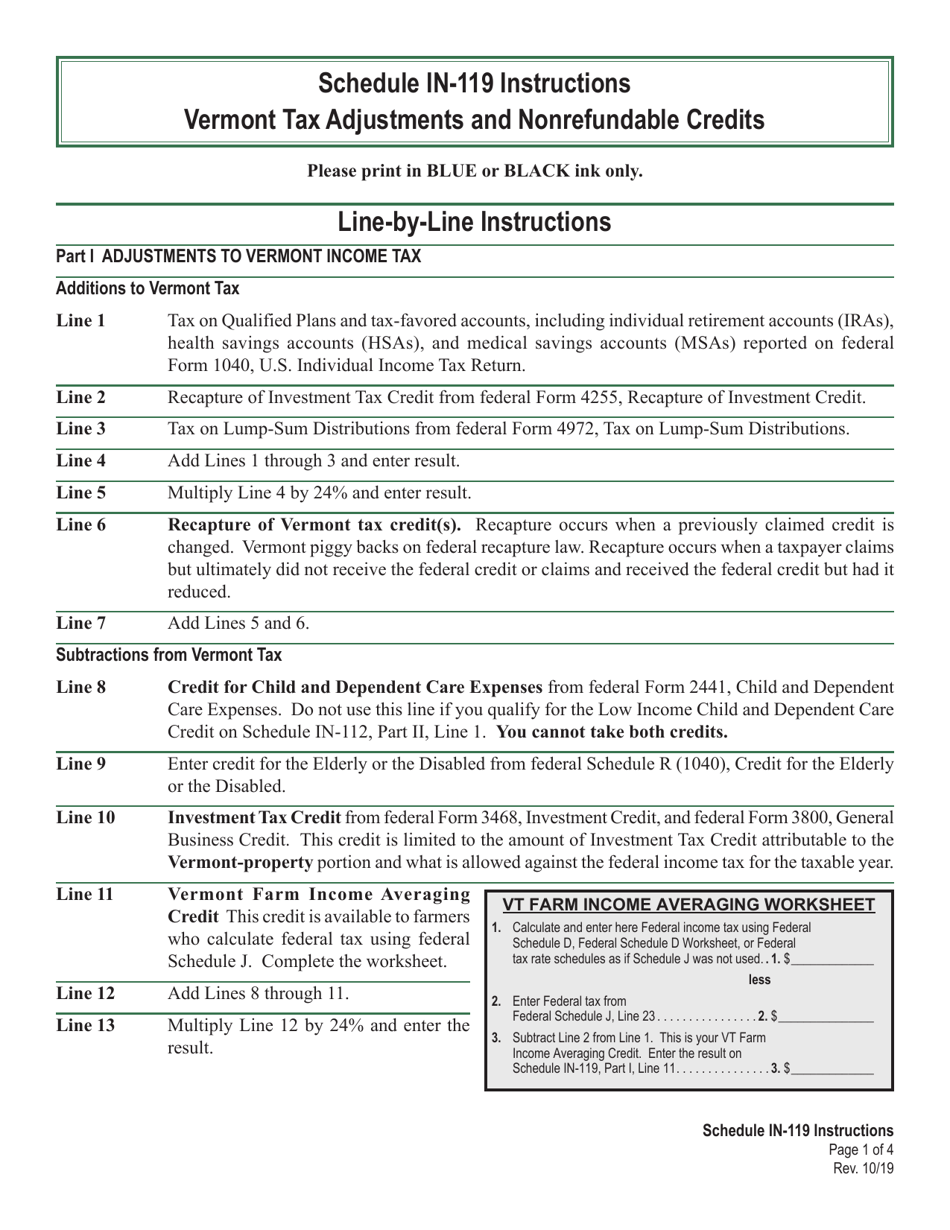

Download Instructions For Schedule In 119 Vermont Tax Adjustments And Nonrefundable Credits Pdf Templateroller

Form In 111 Vermont Income Tax Return

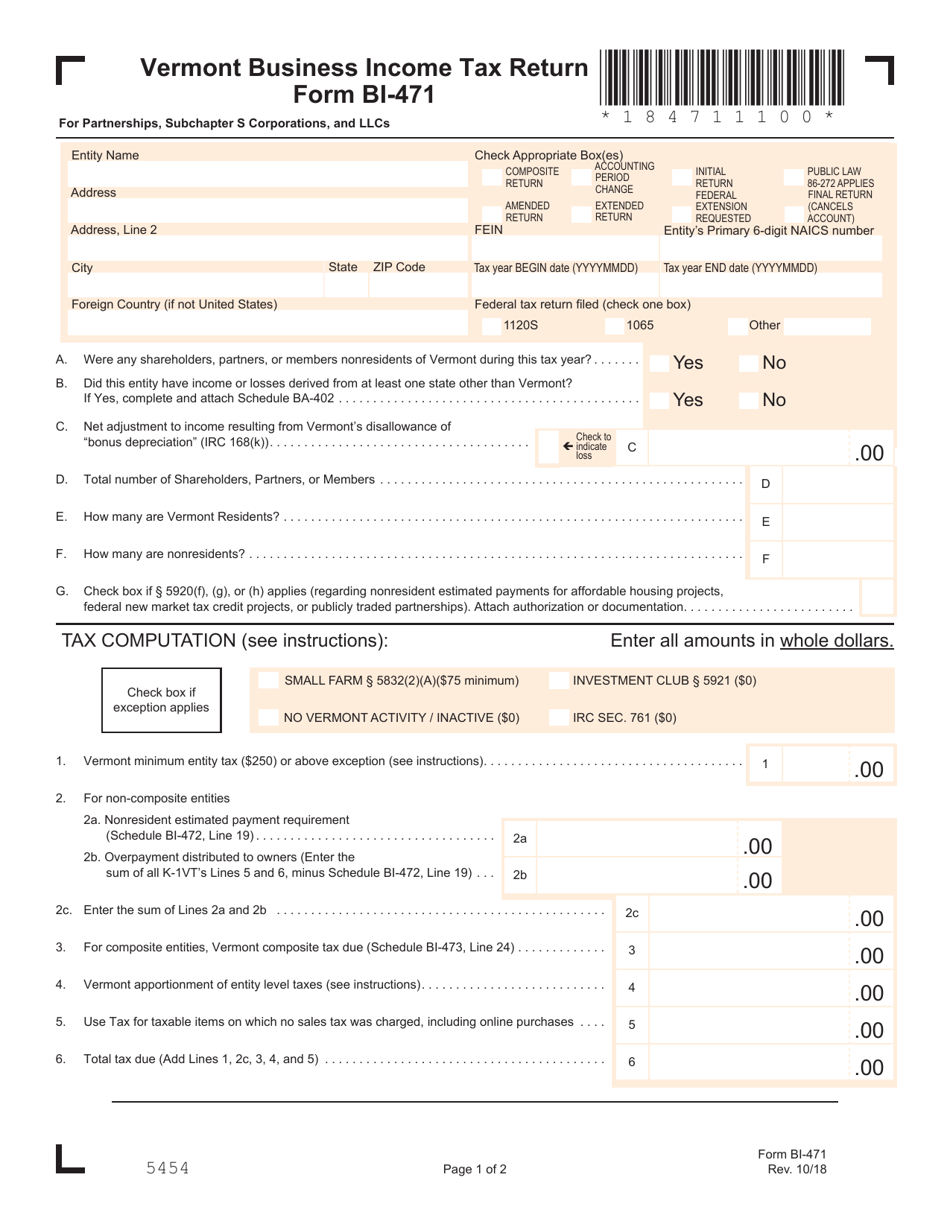

Vt Form Bi 471 Download Printable Pdf Or Fill Online Business Income Tax Return Vermont Templateroller